> A few Fall musings

EXECUTIVE COMMENTARY

A few Fall musings

Walter Tobin, ERA CEO

by Walter E. Tobin, ERA CEO

So, here comes the fall and the dreaded Q4 in our sales/fiscal year cycle. It’s probably chock full of requests of, “How will you finish the year?” and ”I need your budget for 2025,”etc.

We also anticipate the change in the weather…leaves falling and breaking out the sweatshirts and sweaters. Here in Boston, we will tolerate the “leaf peepers” and another year of no baseball in October.

There is a lot going on in our world — a U.S. election approaching (no politics here!), wars/conflicts galore, famine in the Sudan continues, uncertain economic times and excess inventory galore. How do you/we allow all of these factors to “marinate” into our 2025 outlook?

Let me take a moment to reflect on some things that we face together now and in 2025:

• Year-end close. Many of us will want to say good riddance to 2024. Many of us thought it was going to be a turn-around year because the excess inventory that many of us made our customers take (due to enforcing NCNR orders) would magically “burn off ” and would be back in the land of positive book-to-bill ratios and rising backlogs. What will we do in Q4 to try to save the year? Can it even be saved? Do we just want to “take our lumps,” turn the page and start fresh in January 2025? I don’t believe we can save the year in a single quarter. Be careful as to what strategy you choose.

• 2025. What will the new year bring? What “magic” could possibly take place from Q4 to Q1 to change our sales cadence? Probably not a lot. So, look for Q1 and perhaps Q2 to be flat to 2H 2024. We always expect things to get better “in two quarters” — when probably no one really knows. Perhaps the best advice is to: Tighten your belt and continue to march.

• By the time you read this, our annual Sales Training for Electronics Professionals (STEP) training will have taken place. Thanks to our exclusive sponsor, the TTI Family of Specialists, we had approximately 350 registered attendees. What better time to train our front-line sales and marketing professionals than in a flat/down market? I applaud the companies that made the decision to invest in their people now, so as to be better positioned when the market turns back up.

• electronica in Munich on Nov. 12- 15. Are you going? ERA will have a booth once again as we have for the past 30 years! Munich is a long way to go and participation is not cheap. However, we do not look at it as an expense but as an investment in continuing to take the ERA message to EMEA. There is a huge interest by EMEA manufacturers in how to go to market in the Americas. The rep model in EMEA is still predominantly the stocking rep model, who are really distributors. It is difficult if not impossible for this model to continue as the distributors have the financial size and scope to support the marketplace. We will have many reps from the Americas in our booth (#B4, 178) to talk with EMEA manufacturers who want to penetrate the Americas market. There are many manufacturers in the Americas who want to penetrate the EMEA market. We have a growing EMEA ERA chapter who will be at our booth to help plan strategies to help in EMEA. The world is so small and getting smaller thanks to the different technologies that we all use every day.

• ERA Conference – February 23-25, 2025. This is an unabashed plug for our annual conference. It will be sold out once again so register now and book your hotel room. Why come to our conference? To listen and to learn new ways to run your organization better, use new tools, get a peek into the economy and see old friends. The two-plus days are jam-packed with both general sessions and breakout sessions. No golf or boondoggles. (Shucks!) It is an educational conference held on the campus of the University of Texas. (Go Longhorns!) Come and prepare to be amazed!

• Your ERA team. We will end 2024 with some new faces in new roles. We lost our beloved Erin Collins but were blessed to find Kate Van Hise and Natalie Zullo. These two new faces are joining our “veterans” — Karin Derkacz, Clare Kluck, Ama Derringer and Susan Bannwart — to take us into 2025 and beyond. We are all working hard to continue to provide new and exciting benefits to our members. Stay tuned!

• ERA Rep Value Video. As a part of ERA trying to “skate where the puck is going,” we recently posted our first of many videos on the value of the rep model. This three-minute video was a collaboration with Jeff Boos of ANRO Associates and the keen eye of Clare Kluck. Look for videos in the near future.

Whew! So many things to look at. Every month and quarter, we are given ten targets to hit and only given seven arrows, thus missing three targets. And, these are usually the ones that get talked about or scrutinized. What about the seven targets we hit? They almost never get talked about.

Someone told me years ago to focus on getting and keeping the confidence of the customer, versus booking an order. If you keep the customer as your true north, you will book your unfair share of orders over the long haul. So many of us may have given into the pressure of taking the order off the street only then to not be able to fulfill the promises we made to the customer. We end up losing our status as a trusted advisor and lose the customer — perhaps forever.

We all know what to do: make our sales calls, follow up, be open and honest and remain committed to sales excellence.

Things will get better — they always do!

The Electronics Representatives Association (ERA) announces that Erik Qualman, top technology speaker, #1 best-selling author and futurist, will be the keynote speaker at the 2025 ERA Conference, taking place Feb. 23-25, 2025, in Austin, Texas.

The Electronics Representatives Association (ERA) announces that Erik Qualman, top technology speaker, #1 best-selling author and futurist, will be the keynote speaker at the 2025 ERA Conference, taking place Feb. 23-25, 2025, in Austin, Texas.

The October ERA Electronics Components Industry Trends survey is now in your inbox! Check your inbox and fill out the survey today.

The October ERA Electronics Components Industry Trends survey is now in your inbox! Check your inbox and fill out the survey today. > ERA proudly introduces

> ERA proudly introduces  > There is still time to register for ERA’s annual

> There is still time to register for ERA’s annual

> Don’t forget to secure your spot at the 2025

> Don’t forget to secure your spot at the 2025  > ERA

> ERA  > ERA is now accepting reservations for ad space in the Fall 2024 issue of

> ERA is now accepting reservations for ad space in the Fall 2024 issue of  Automation is at the heart of modern industries and is driving forward the digital transformation in almost all sectors.

Automation is at the heart of modern industries and is driving forward the digital transformation in almost all sectors.  — Kate Van Hise has joined ERA as Events Manager to replace Erin Collins who recently left ERA. Kate resides in Rockford, Ill., and is a graduate of Illinois State University. Kate joins us with superb experience in managing different types of events and conferences, facilitating sales training and listening skills courses. Kate will be managing the 2025 ERA Conference in February 2025.

— Kate Van Hise has joined ERA as Events Manager to replace Erin Collins who recently left ERA. Kate resides in Rockford, Ill., and is a graduate of Illinois State University. Kate joins us with superb experience in managing different types of events and conferences, facilitating sales training and listening skills courses. Kate will be managing the 2025 ERA Conference in February 2025. — Natalie Zullo has joined ERA as Operations Specialist, a new position for ERA. Natalie is a graduate of East Carolina University and resides in Greenville, N.C. She comes to ERA from the healthcare industry with a specialty in family and community services and child development. Natalie will be involved in many different areas of ERA, supporting the team with her strong operational and organization skills.

— Natalie Zullo has joined ERA as Operations Specialist, a new position for ERA. Natalie is a graduate of East Carolina University and resides in Greenville, N.C. She comes to ERA from the healthcare industry with a specialty in family and community services and child development. Natalie will be involved in many different areas of ERA, supporting the team with her strong operational and organization skills.

— Ama Derringer, Membership Services Coordinator, will be taking on the role of ERA Chapter support and supporting the efforts of the various ERA chapters. She will be partnering with Cam English to facilitate COLT training on October 6-8. She will also represent ERA at electronica in Munich, Germany on November 11-14.

— Ama Derringer, Membership Services Coordinator, will be taking on the role of ERA Chapter support and supporting the efforts of the various ERA chapters. She will be partnering with Cam English to facilitate COLT training on October 6-8. She will also represent ERA at electronica in Munich, Germany on November 11-14.

Thank you,

Thank you,

> The entire detailed list of training sessions for

> The entire detailed list of training sessions for  > Are you attending

> Are you attending  > Reminder: Secure your spot at ERA

> Reminder: Secure your spot at ERA

> The Summer issue of The Representor is now online and in mailboxes! Read the

> The Summer issue of The Representor is now online and in mailboxes! Read the  > Save the date for Feb. 23-25, 2025! The annual

> Save the date for Feb. 23-25, 2025! The annual

>

>

Electronics is a key factor in the energy transition and development of smart energy solutions. That is why smart energy will be a key topic at

Electronics is a key factor in the energy transition and development of smart energy solutions. That is why smart energy will be a key topic at

> Registration for ERA

> Registration for ERA

> What does recovery look like?

FROM THE TOP

What does recovery look like?

by John O’Brien, CPMR

ERA Chairman of the Board

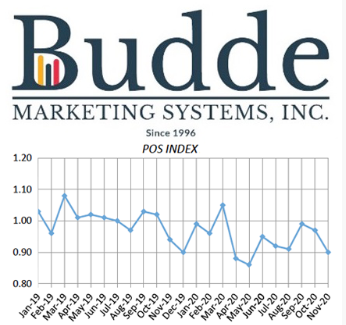

How many of us are asked in meetings, “What do you see for recovery of the electronics industry?” Let’s face it, everyone is skeptical about when a recovery will occur, most people not venturing out more than two quarters to look for the growth we all know will return. Our industry is so cyclical that we often go through great periods of growth followed by short periods on flat or contraction. For those who have been around awhile, we can look back at the dotcom bust or the allocation periods, for example.

What I believe we are experiencing this time around are multiple forces driving our industry, but not always in the same direction. Going back to 2019/2020 and the COVID-19 era, expectations when COVID-19 first hit and everything shut down were that our industry would face a big downturn. I remember a meeting in March 2020 when we discussed how we would adjust to an anticipated drop in sales and revenue. As our people moved to work-from-home, it drove a surge in the very products we supply to support his new work model. As concerns arose over testing and treatments, our medical markets began to thrive.

Then 2021/2022 hit and the disruption in supply chain started to take hold. Customers bought usages going out a year so they could try to maintain their production. Then when they couldn’t get parts, they opened up their BOMs to cover build demands.

2023 rolled around and everyone was sitting on too much inventory. Everywhere throughout the supply chain, distributors, CEMs and OEMs all had raw materials inventory and in many cases, finished goods, that outpaced the end customer demand. So, throughout 2024, we’ve been tracking inventory work-downs. We’ve been watching end customer shipments but up until recently, design efforts were limited to sustaining engineering. Recently, we’ve started to see an increase in new product designs. These new designs are definitely taking longer and there are fewer going on at the same time.

So do these factors signal a recovery? I’ll get back to my original premise, “How do we define recovery?” If we look at recovery as a return to sales numbers equal or greater to the heights we’ve seen (for us that was 2022), then I believe we are still a ways out from there. Price pressures from the OEMs are causing lower overall sales, but, with similar volumes we’ve seen prior. Most recently, I’ve spoken to a number of folks at principals, distributors and CEMs and many are looking at 2019/2020 as a comparative time frame to 2024 and beyond. Everything I outlined previously in the article “artificially” inflated our numbers, so a comparison to a more stable time may help provide greater insight into what’s happening.

No matter how you define recovery, we all learned a valuable lesson over the past four years. We are a resilient industry that touches so many markets that help offset downturns. We are also an adaptive industry that sees these changes and can react quickly. Working together as reps, manufacturers and distributors, we will recover and be stronger than before.